Updated January 21, 2026

Conquering Japan's Year-end Tax Adjustment [2025 Guide]

As a foreigner living in Japan, it’s easy to get lost in paperwork, especially if you’re coming from a country where government procedures are vastly different.

The year-end tax adjustment, or Nenmatsu Chosei (ねんまつちょうせい), is one of the official government procedures that may confuse or overwhelm those who are new to the country. However, the process is actually quite easy to manage as long as you know what you’re doing, which is what I’m here to help with today.

In this post, I’ll explain what the year-end tax adjustment is for and how you can file your year-end tax adjustment declaration. I’ll also explain what a tax withholding statement is and how it can be used by prospective employers to find out your previous salary.

So, what exactly is a year-end tax adjustment? Let’s find out.

In this article: 📝

The Japanese Year-End Tax Adjustment: What Is It?

As is the case for many other countries, the Japanese tax system also has a tax withholding system that aims to minimize the costs that occur during tax collection and combat the tax evasion problem. This system also allows governments to have stable revenue from taxes throughout the year.

According to this tax system, employers are required to withhold a portion of an employee’s salary each month as income tax.

So, in the simplest possible terms, the year-end tax adjustment is a process that involves comparing the income tax amount you owe at the end of a year to the actual amount your employer withheld from your salary as your income tax.

If it turns out that you’ve paid more out of your salary than you’re supposed to, at the end of the year, you’ll be eligible for a tax refund. If the opposite is true, and the amount you paid is less than the actual amount you owe, you’ll need to pay the difference.

So, Why The Adjustment?

At first glance, it’s not hard to understand the tax withholding system, but the concept of owing the government money at the end of the year may be confusing to some.

You may ask, “If my income tax is paid regularly out of my salary each month, and the amount is certain from the get-go, what changes throughout the year?”

Well, the reason is simply that the withheld income tax that’s paid out of your salary every month is actually calculated as an estimation.

The amount is simply estimated at the beginning of the year according to your wage and your dependents, so if any of those factors change at a later time, the year-end calculation will differ from the estimate.

Said factors may include switching jobs, getting a promotion, or other changes related to your family or salary, and it’s impractical for the government to keep track of such things regularly.

For instance, your spouse may have lost their job at some point during the year, and they may have been unemployed ever since. Similarly, your dependents may have changed due to the passing of a family member or a child becoming financially independent.

So, all of these changes that potentially occur during the year are then accounted for, and your actual tax amount owed is calculated by comparing it to the amount withheld.

As a result, you’ll be paid for the excess amount you paid or billed for the amount you owe.

To summarize, the year-end adjustments are your way to get even with the government by getting things settled, but how do you know if you’re subject to year-end tax adjustments?

Who Is Year-End Tax Adjustment (Nenmatsu Chosei) For?

For starters, let’s make it clear that the year-end tax adjustment (nenmatsu chosei) is for employees who reside in Japan, which means that if you’re working for a wage and are an inhabitant of Japan, you’re subject to nenmatsu chosei.

However, if you’re a freelancer or self-employed, you aren’t subject to nenmatsu chosei. Instead, you’ll need to file a final income tax return or kakutei shinkoku (確定申告), which I’ll also touch on later in this article.

While being a wage-earning employee is the first criterion, in some cases, you might find out that you’re actually not subject to the year-end tax adjustment. Here are the exceptions:

Working for a non-Japanese company (that isn’t a Japanese branch of an overseas company);

Being employed by multiple companies or having side jobs;

Leaving Japan after resigning from/leaving a Japanese company before the end of the year;

Your other incomes (if any) surpass 200,000 JPY annually;

Earning over 20 Million JPY annually.

So, if you meet any of the conditions above, you won’t be subject to the year-end tax adjustment but to the kakutei sinkoku (final income tax return) instead, which I’ll get to in a bit.

Also, keep in mind that you will only be exempt from the year-end tax adjustment if you’re directly employed by an overseas company. If it’s a Japanese branch of an overseas company, however, this is considered as a Japanese company, and you’ll be subject to the year-end tax adjustment.

On the other hand, while you are subject to year-end tax adjustment as an employee, you’re not responsible for filing the nenmatsu chosei yourself. As each year comes to an end, the year-end tax adjustment is supposed to be filed by your employer by January 31st of the following year.

However, in order for your employer to file the nenmatsu chosei, you need to provide them with certain information that will help determine the actual income tax amount you’re subject to.

What Is Kakutei Shinkoku (Final Income Tax Return)?

If you don’t qualify for the year-end tax adjustment due to one of the reasons I mentioned above, you’ll have to file for a final income tax return, also known as kakutei shinkoku (確定申告).

You can file for kakutei shinkoku between February 16th and March 15th, and the process can be done at your local tax office as well as online through E-Tax, the official electronic filing portal of the Japanese National Tax Agency.

Alternatively, you can also use eL-Tax, which is another online tax payment system that’s approved by the Japanese government. Keep in mind that while E-Tax has a guide in English, eL-Tax has no English support.

You can file for kakutei shinkoku in two ways: blue tax return (aorio shinkoku; 青色申告) and white tax return (shiroiro shinkoku; 白色申告). Which one you’ll go with is a matter of preference.

That being said, the blue tax return is usually preferred over the white tax return due to the benefits it offers, such as special tax deductions. Individuals are free to choose one of the two when they establish their businesses by notifying their local tax office.

Still, the white tax return may prove to be more beneficial to you depending on your circumstances, so it’s best to check with a professional before making a decision.

What Documents Do Employees Need to Prepare for Nenmatsu Chosei?

As the end of the year approaches, your employer will provide you with a few forms that you need to fill out and update the information that may affect the amount you owe in income tax. These forms are all related to your personal data that may alter your tax status and liability and, therefore, will affect your year-end tax adjustment accordingly.

For instance, if your dependents have changed during the year, you’ll need to fill out a dependent exemption form. Similarly, if you have insurance such as life insurance, earthquake insurance, and private health insurance and have paid premiums during the year, you’ll need to fill out an insurance exemption form as well.

In addition to these, your tax liability may also have changed during the year due to a house loan you acquired, which you will also need to declare through a separate form.

For each item, you’ll need to calculate the amounts accurately, so it might be a good idea to ask for the HR department’s help at your company when filling out these forms. Just like in the U.S., making a mistake as you’re completing a tax procedure should be avoided at all costs, as the consequences can be tricky to deal with.

In addition to these forms, another document you’ll receive from your company at the end of the year is the gensen choshuhyo (源泉徴収票), the withholding tax statement. Let’s take a look.

What Is The Withholding Tax Statement?

The withholding tax statement, or gensen choshuhyo (源泉徴収票), is a document you’ll receive from your employer as the end of the year approaches. This usually happens around November to December.

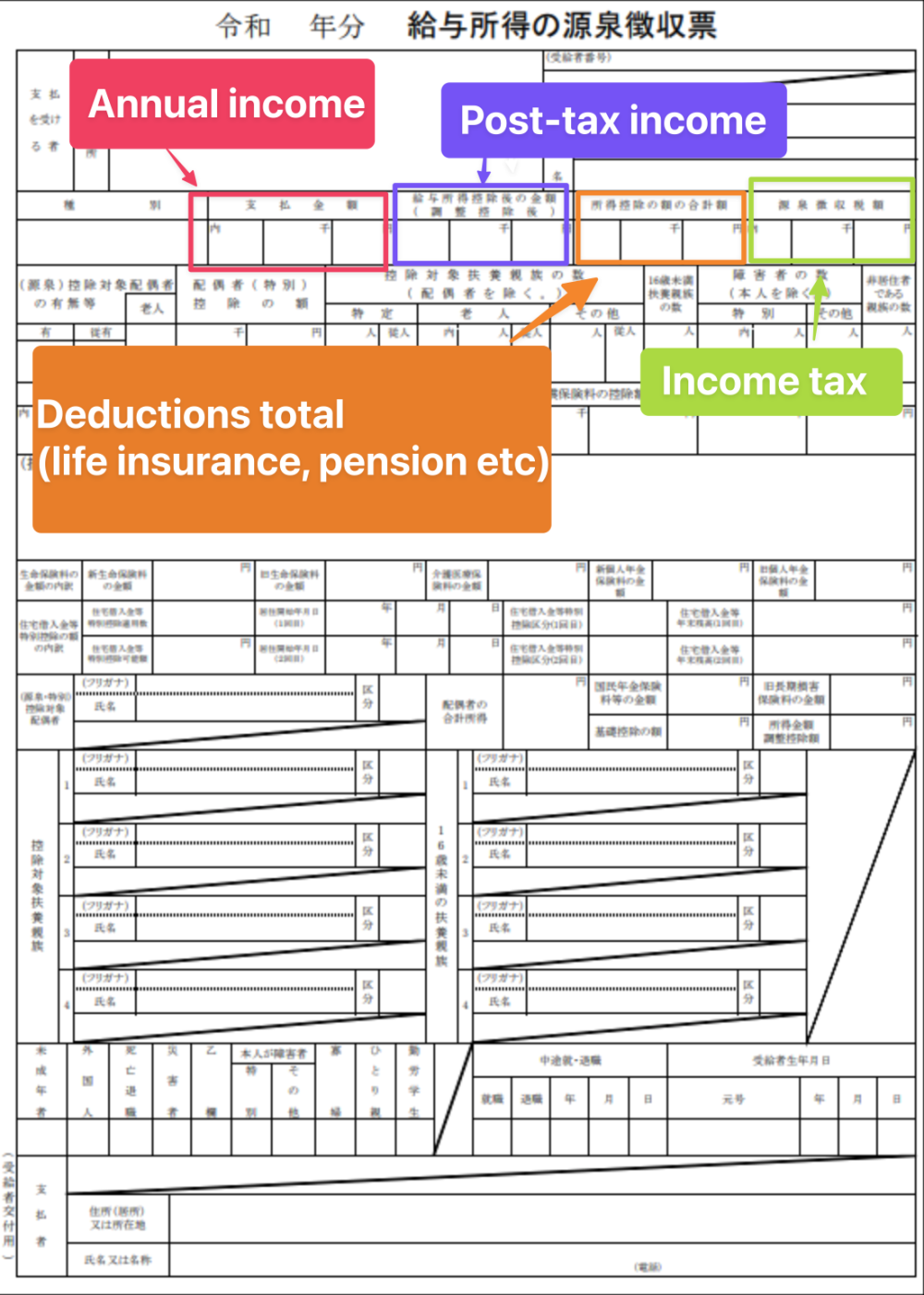

The withholding tax statement includes information such as the amount you’ve paid in taxes during the year and the amount you’ve earned in salaries. If you’re wondering what a withholding tax statement looks like, here’s a picture for reference.

In a withholding tax statement, there are four sections you need to check and make sure that the information is correct.

The first part is the 支払金額 (shiharai kingaku), which means “the amount paid.” This refers to the salary you earn, including the overtime pays you received, as well as any bonuses you may have gotten throughout the year.

The second part you need to check is 給与所得控除後の金額 (kyūyo shotoku kōjo-go no kingaku), which means “the amount after employment income reduction,” which is an amount determined by the National Tax Agency. Basically, in this section, the amount that’s left after the employment income deduction is stated.

Another thing you need to check when you receive your withholding tax statement is the 所得控除の額の合計額 (shotoku kōjo no gaku no gōkei-gaku), which means the total amount of income deduction.

This simply refers to the reasons for potential deductions I mentioned above, such as insurance premiums you’ve paid, the change in your dependents, or any house loans you may have taken out. All of these are calculated together as the total amount of income deduction.

Lastly, the final section you need to make sure is correct is the 源泉徴収税額 (genzenchōshū zeigaku), which means “the withholding tax amount.” As you may have guessed, this refers to the total amount of income tax paid out of your salary and is crucial for your year-end tax adjustments to be calculated properly.

How the Withholding Tax Statement Can Give Away Your Salary

When you apply for a job in Japan and go in for an interview, you should be prepared to answer some questions that might be hard to answer. In fact, I talked about all of the potential questions you may face when you interview for a job in Japan in another post extensively.

However, there’s one question that’s among the hardest to answer, and it’s not uncommon — Inquiries about your previous salary.

In Japan, companies may often ask what your salary at your previous job was, and traditional companies are the worst offenders in this regard. You can choose not to disclose this information, of course, but some people fear this can harm their ability to get an offer. At Japan Dev, we recommend politely declining to tell prospective companies your previous salary.

You might be tempted to give a fake number, one that you think will impress the company you’re interviewing for, but I strongly suggest otherwise, as there are a couple of ways companies can find out your actual previous salary later down the line, which isn’t ideal, to say the least.

The first way the company can find out your previous salary is by looking at your withholding tax statement.

As I mentioned, the withholding tax statement doesn’t just include the income tax amount you paid in a year, but it also includes the amount you get paid.

If you happen to leave your job, you’re still required to hold on to your withholding tax statement because it’s usually required by companies when you apply for a new job.

The reason the company asks for the statement is that they will have to file for your year-end tax adjustment, as you’d be their employee at that point.

Luckily, you can get around this by telling them you don’t have the document, as it wasn’t provided by your previous company. Alternatively, you can claim that you did side jobs while your previous company employed you and weren’t subject to the year-end tax adjustment.

However, if you don’t want to present your withholding tax statement to your company, this means that you’ll have to file for your own tax return yourself. This is needed as your employer will no longer be able to file for your tax returns, so you’re going to have to be the one to do it.

So, make sure to tell your employer that you’re going to be filing your tax returns yourself, and it should be fine.

Despite this workaround, however, I still strongly advise against exaggerating your previous salary. Here’s why.

Other Ways Companies Can Find Out Your Previous Salary

Even if you manage to pull it off and not disclose your withholding tax statement with the company you’re interviewing for, the company still has another way of finding out a rough estimation of your previous salary.

In addition to the national income tax, there’s another form of income tax in Japan, and that is the Resident Tax, or Juminzei (住民税), also known as the local income tax.

You don’t have to do anything yourself; this tax is simply paid by your employer, and it’ll be deducted from your salary. What can give away your previous salary here is the fact that this tax is calculated according to your income the previous year.

When the local income taxes are due, both you and your employer will receive a notification from the government regarding the amount to be paid. As this notification contains the amount due, your employer can get a rough idea of what your salary was in the previous year.

Now, as I said, this only allows for a rough estimation, as your employer doesn’t know how much has been deducted or whether you’ve had an additional source of income during this period. Still, if you happen to give a fake number that’s way off, it can be an instant tell.

Local Government’s Privacy Protections Might Not be Perfect

Even if the previous method merely provided an estimate, there are yet more loopholes where a prospective employer may learn your past salary. This is where the local government comes in, as not all of them do things as exactly as they’re supposed to.

As the notifications for the local income tax are sent to both you and your employer, they’re sent directly to the company; the individual one you’re supposed to get has to be handed over to you once the company receives it.

Unfortunately, there are occurrences where some local government employees may forget to send your personal notification sealed. This is a big problem if your employer doesn’t play by the rules.

You see, while the notification your employer gets doesn’t include specifics like your salary and other income in detail, the notification that’s for your eyes only includes these numbers as well. So, you can imagine how easy it is for an employer to guess your previous salary when this is the case.

Luckily, this still doesn’t provide your employer with an exact number, as they still have no way of finding out whether you’ve had a pay raise or received any bonuses in the previous year, but it still gives them a general idea.

Keep in mind, however, that while this doesn’t always happen, and most local government employees do their jobs diligently, it’s still in the realm of possibility.

If you want to learn more about other potential hurdles you may face during the job-seeking process and how you can overcome them, make sure to check out my post on job hunting in Japan once you’re done here.

In addition, if you’re curious about how Japanese job interviews usually go and are in need of some pointers, you can head on over to my post on the best interview tips for landing your dream job in Japan.

Frequently Asked Questions

As you can see, the income tax system in Japan isn’t all that complicated. You just need to familiarize yourself with a few basic concepts, and the rest is easy. However, while I tried to be as comprehensive as possible, there may still be some points that are left unclear.

So, before I close out this post, let’s answer a few frequently asked questions on the subject and revise some key points.

What Is The Nenmatsu Chosei?

Nenmatsu chosei is Japan’s year-end tax adjustment system. The adjustment for the previous year is supposed to be done by January 31st of the following year. As an employee, you don’t need to file for nenmatsu chosei yourself, as it’s your employer’s duty.

Nenmatsu chosei exists because the taxes are billed based on your earnings from the previous year. As your taxable income and your tax liabilities may change, an adjustment is made at the end of the year, which usually results in you receiving some tax returns.

The opposite can also be true, however, as the adjustment may reveal that the amount you paid is lower than the amount that’s actually due.

Am I Responsible for My Year-End Tax Adjustment Declaration?

As an employee, you aren’t responsible for filing for the year-end tax adjustment. Your employer does it for you.

That being said, if you’re working multiple jobs, working for a non-Japanese employer directly (and not for a Japanese branch of an overseas company), leaving Japan upon resigning from a Japanese company before the end of the year, have other incomes surpassing 200,000 JPY annually, or earning over 20 Million JPY annually, you aren’t subject to the year-end tax adjustment.

What Is Gensen Choshuhyo?

Gensen choshuyo is the tax withholding statement, which is a document you’ll receive from your employer towards the end of the year. It shows important information regarding your taxable income and your yearly earnings, as well as the total amount deducted from your income.

Prospective employers may occasionally request this document during the hiring process to verify the candidate’s previous salary, which you can work around, as I explained. In any case, it’s needed by your new employer, as they’ll have to file for nenmatsu chosei at the end of the year on your behalf, so most companies ask for it during the onboarding process.

Can Companies Ask for My Withholding Tax Statement Before They Hire Me?

While there’s no reason for them to do so, some companies may still ask for your withholding tax statement during the interview process. This is solely because they want to make sure that you’re not lying about your previous salary.

These are very likely to be old-fashioned companies that are very strict with money, so, I recommend exercising caution if a company ever asks you for your withholding tax statement before you’re hired.

The reason the withholding tax statement is needed is that the company will be responsible for your year-end tax adjustments once they hire you, but this doesn’t happen before you’re hired, so you don’t have to give it in advance.

Some companies, however, may decide not to go through with your application if this is the case. As this can signal the existence of unethical work practices, as in the black companies I mentioned in another post, this may turn out to be a blessing in disguise.

Can a Company Find Out My Exact Salary from My Withholding Tax Statement?

No. It’s not possible for a company to find out what your exact salary was at your previous job. However, the withholding tax statement can still provide the company with a rough estimate.

Similarly, your local income tax notification can also provide your employer with a rough idea, but this is only possible after you’re hired, as the notification won’t be sent to a company that hasn’t yet hired you.

What’s more, unlike the withholding tax statement, companies can’t ask for this in advance, as this notification is only sent to your place of employment when the taxes are due automatically.

What's Changing in Japan's 2025 Tax System (And Why It Matters to You)

If you're going through the year-end tax adjustment process after December 2025, there's something very important you need to know: The rules have changed, and in a big way.

The Japanese government announced revisions to the income tax system, effective December 1, 2025. This isn't just another minor tweak to the tax code, either. It's the largest expansion of deductions in decades, and depending on your situation, you could be looking at significant tax savings, or missing out on money you're entitled to if you don't file the right forms.

So, what exactly changed, and why should you care? Let's break it down.

Why the Japanese Government Overhauled the Tax System

For years, Japan's tax thresholds have been creating real problems for working families. The infamous 1.03 million yen barrier forced students to artificially limit their part-time hours, even as tuition costs and living expenses kept climbing.

As a result of this, parents faced a harsh "cliff effect," which meant that if their child earned even a few thousand yen over that threshold, the entire dependent deduction vanished.

The 2025 reforms aim to fix these issues by modernizing outdated thresholds and introducing new deductions. The changes apply to income tax for the 2025 fiscal year and beyond, which means your December 2025 year-end tax adjustment will be the first one affected.

The Four Big Changes You Need to Know About

The 2025 tax reform touches four key areas. Each one could affect how much you pay in taxes, or get back as a refund.

1. Revision of the Basic Deduction

The basic deduction is exactly what it sounds like: It’s a standard amount that everyone can deduct from their income before calculating taxes. Now, the government has raised this deduction substantially.

For most people, the basic deduction increased from 480,000 yen to 580,000 yen, but here's where it gets interesting: If your income is under approximately 2 million yen, you now qualify for an even larger deduction of 950,000 yen. That's double the previous amount.

So, what does this mean in practical terms? Depending on your income level, you could see tax savings ranging from around 30,000 yen (if you earn about 2 million yen) to a whopping 180,000 yen (if you earn closer to 6 million yen annually).

If you're earning over 25.45 million yen annually, the basic deduction stays at 0 yen.

2. Revision of the Employment Income Deduction

This deduction recognizes that employees can't write off business expenses the way self-employed people can. So, with the new changes to the rules, the government increased the employment income deduction for those earning under 1.9 million yen from 550,000 yen to 650,000 yen.

This change is particularly helpful for part-time workers and students. Combined with the basic deduction increase, it means you can earn more before you start owing significant taxes.

3. Establishment of a Special Deduction for Specified Relatives

The biggest change that comes with the new legislations i perhaps the brand-new "Special Deduction for Specified Relatives," or tokutei shinzoku tokubetsu koujo (特定親族特別控除) in Japanese.

If you remember that 1.03 million yen barrier previously mentioned, this new deduction finally remedies the challenge that barrier created. Basically, if you have a child or dependent (typically aged 19-22, like university students) who earns between 1.03 million yen and 1.5 million yen, you can still claim a special deduction up to a maximum of 630,000 yen if you have one child who meets the conditions for a new deduction.

Under the old rules, exceeding that 1.03 million yen threshold meant losing the entire special deduction. Now, as long as your child's taxable income amount stays under 1.5 million yen, you're safe. For parents, this could save between 70,000 and 170,000 yen annually, so it really is a big deal.

Here's the catch, however: This deduction doesn't apply automatically. You need to submit a specific form to your employer called the "Special Deduction Declaration for Specific Relatives of Salaried Earners." If you don't submit this form, you won't get the deduction, even if you qualify.

Many companies aren't emphasizing this new requirement, and employees are rushing through their year-end forms without realizing there's a new field they need to complete. So don't be one of them.

4. Amendment to the Income Criteria for Dependents and Related Persons

The government also adjusted the income limits for who qualifies as a dependent, raising all the thresholds in line with the increased basic reduction.

Here’s what changed:

For dependents and spouses living in the same household, the total income requirement increased from 480,000 yen to 580,000 yen. Your family members can now earn 100,000 yen more (annually) while still qualifying as your dependents.

For children of single parents, the income threshold also rose from 480,000 yen or less to 580,000 yen or less, giving single-parent households more flexibility.

As for working students, the income requirement for the working student reduction (kinrou gakusei koujo) increased from 750,000 yen or less to 850,000 yen or less, allowing students to work more without losing their tax benefits.

Lastly, for those doing contract work from home, the minimum guaranteed expense deduction for calculating business income increased from 550,000 yen or less to 650,000 yen or less.

The thresholds have been recalculated to align with the increased basic and employment income deductions, allowing dependents to earn more before they lose their status.

What This Means for Your Year-End Tax Adjustment

If you're employed by a Japanese company, your employer is required to file your year-end tax adjustment by January 31st, 2026. Remember that they can only process the deductions if you provide them with the correct information.

This year, pay extra attention to any new forms or sections in your year-end tax paperwork. If you have dependents, especially college-age children working part-time, make sure you fill out the Special Deduction for Specified Relatives form.

If you've already submitted your forms and realized you missed something, don't panic. You can request a recalculation from your employer until January 30th, 2026. After that, you'll need to file your own tax return (kakutei shinkoku) between February 16th and March 15th, 2026, to claim any missed deductions anyway.

Get Job Alerts

Sign up for our newsletter to get hand-picked tech jobs in Japan – straight to your inbox.