Updated February 12, 2025

Pension in Japan: What Foreign Workers Need to Know

Navigating the pension system in Japan can be challenging, especially if the rules and processes vary significantly from those in your home country. However, knowing how this system works is essential for anyone working in Japan, including foreigners.

Understanding the national pension system is not only crucial for securing your financial future but also for ensuring compliance with local regulations.

In this guide, we’ll explain the pension in Japan for foreigners and how the system works so you can make informed decisions about your pension contributions and benefits.

Let’s start with an overview of the pension system in Japan.

In this article: 📝

Japanese Pension System Explained: An Overview

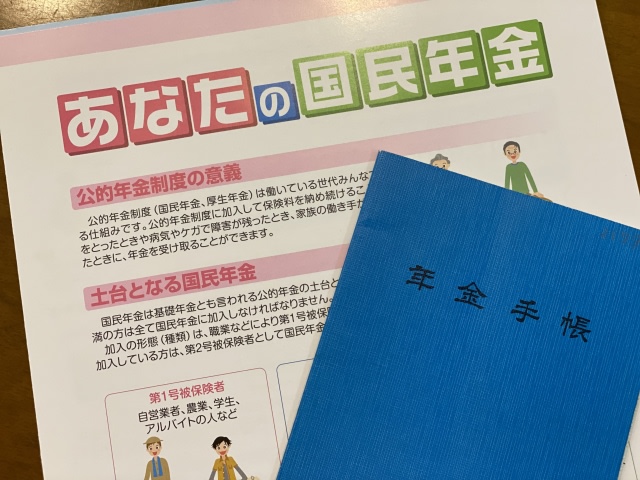

The pension system in Japan is designed to provide financial support to residents after retirement, during periods of disability, or in the event of a breadwinner's death. The system is primarily divided into two main categories:

Employees’ Pension Insurance (Kōsei Nenkin, 厚生年金): This system caters to individuals under 70 employed by companies and organizations. Both employers and employees contribute to this plan, with premiums calculated based on the employee's income. Benefits from the system include old age pensions, disability pensions, and survivor pensions.

National Pension System (Kokumin Nenkin, 国民年金): The system is mandatory for all residents aged 20 to 60 who are not eligible for employees’ pension insurance, such as self-employed individuals, part-time workers, and students. The national pension also provides pensions for old age, disability, and surviving a spouse, but here everyone pays the same amount.

How To Enroll in The Pension System in Japan: Is Pension Mandatory in Japan?

As you can see, the process of enrolling in the pension system in Japan depends on your employment status. The distinction between national pension and employees’ pension ensures that every resident contributes as much as they can.

Enrolling In Pension Insurance If You’re Employed

Those working full-time or on a company payroll will be glad to know that your employer will handle the enrollment for your employee's pension insurance.

This includes calculating all deductions, so you don't need to deal with any forms or applications yourself.

Enrolling in Pension If You Aren’t An “Employee”

If you're self-employed, a freelancer, working part-time, or not covered under the employees’ pension insurance, you will need to enroll in the National Pension System yourself.

To enroll, simply head to your local City Hall’s pension desk with your residence card and proof of address. The staff there are typically helpful and will guide you through the registration process.

How To Contribute To The National and Employee Pension System in Japan

If you're employed, the contributions for the employees’ pension insurance are deducted automatically from your salary.

This shared responsibility system ensures that both you and your employer contribute an equal share to your future pension, making it a straightforward process that requires the least amount of effort on your part.

However, if you are self-employed, a freelancer, or not enrolled in the employees’ pension insurance for other reasons, you'll need to handle payments for the National pension system yourself.

Payments for the national pension system can be made through various convenient methods, including:

Bank transfers: You can set up automatic payments at your bank to avoid missing any payments.

Convenience stores: Many Konbini stores accept pension contributions, so you can simply head to the nearest one to pay.

Online banking: You can set up automatic payments or pay monthly at your own convenience without leaving home.

As we mentioned, the contributions for the national pension system are flat-rate, and the government sets the exact amount each year. For reference, the contribution amount for the national pension in the fiscal year of 2024 was 16,980 yen a month. You can check the official page for the National Pension system to stay informed of the updated rates in the future.

Pension in Japan Age: When Do You Start Receiving Japan Pension Benefits?

In Japan, pension benefits are typically accessible at age 65 to help people maintain financial stability in retirement. That said, the system offers some flexibility.

You can opt for earlier retirement benefits starting at age 60, but this option will reduce the monthly amount you receive as it’s calculated based on an extended payout period.

The system also supports those who wish to postpone their pension beyond 65 years. This is a popular choice among many Japanese people, as delaying the start of your pension can result in higher monthly payments, providing a larger financial cushion later in life.

Many even get rehired by their companies in different roles after 65, as we explored in our “Retirement Age in Japan” post.

Also, keep in mind that the exact adjustment rates for early or postponed pensions depend on criteria such as your enrollment period and contributions. So, it’s crucial to understand your options well in advance and calculate the risks.

Speaking of calculating, let’s see how to calculate your future pension.

How Much Is Pension in Japan?: Pension in Japan Calculator

While it’s possible to estimate your future pension benefits, exact calculations are challenging due to a couple of reasons:

Changing rates and inflation: Your pension benefits are calculated using specific formulas that use rates set by the government. As these are updated yearly, it's impossible to know what your exact benefits will be. Adding to this the effects of the unforeseeable inflation, this becomes an even more difficult task.

Updated salaries and bonuses: While you can calculate your preview salaries and bonuses, the ones you haven't received yet are harder to determine, especially for a period of 10, 20, or 30 years.

With this in mind, let's see how to calculate the benefits of the national and then employee pension insurance.

Calculating National Pension Benefits

For those enrolled in the national pension system, calculating future benefits involves a somewhat simple formula since contributions are flat-rate and determined by the government.

To receive the full pension amount, you need to have contributed for 40 years or 480 months. At the time of writing this article, the full pension amount is 816,000 yen annually.

In this system, each month you contribute adds to your eligibility, with benefits reduced proportionally if you contribute for fewer years. So, if you contributed for 20 years, which is half of the total period of 40 years, it would result in approximately half of the annual full pension amount we mentioned.

Calculating Japan Pension Benefits: Employees Pension Insurance

Unlike the national pension insurance benefits, calculating benefits under the employee's pension insurance is more complex.

This is mostly because it heavily depends on variables such as your income and contribution history but also because of the formulas and rates involved, which are subject to change over the years.

Mainly, however, the following two variables determine your upcoming benefits:

Your average monthly standard remuneration: This includes your salary and bonuses during your years of enrollment in the program.

The length of your enrollment: The more years you contribute, the higher your benefits will be.

The formula for calculating the annual benefits of your employee pension insurance between the ages 60 to 65 is comprised of A + B + C, which are:

A – The Fixed-Amount Portion: Revised rate for the current fiscal year x A multiplier based on your date of birth x Number of months you’ve contributed up to 480 months.

B – The Remuneration-Related Portion: (Average standard monthly salary × 7.125 ÷ 1000 × number of months of enrollment period up to March, 2003) + (Average standard monthly salary × 5.481 ÷ 1000 × number of months of enrollment period since April, 2003)

C – Transitional Additional Benefits: 1,621 yen (2022 fiscal year) x rate according to date of birth x number of months of enrollment period-amount of basic old-age pension

D – Additional Annual Benefits: You can get a bigger pension by paying an extra 400 yen each month on top of the fixed premium. The additional annual benefit is calculated by multiplying the number of months for which the additional premium has been paid by 200 yen.

With this information in mind, you can calculate your annual pension benefits past the age of 65 by adding up:

A or The Fixed-Amount Portion

B or The Remuneration-Related Portion

C or Transitional Additional Benefits

D or Additional Annual Benefits

How Much Will Be Deducted From Your Monthly Salary?: Pension in Japan How Much

The contribution amount for the National pension insurance is flat-rate and, therefore, doesn’t need any calculations. If, however, you’re subscribed to the employee’s pension insurance, the contributions will be deducted in the following manner:

Regular monthly contributions: Your contribution is determined by multiplying your standard monthly remuneration (your pensionable monthly salary, which includes wages and allowances) by a specified contribution rate.

Bonus contribution: For the months when you receive a bonus, the calculation also involves your standard bonus amount, which is the bonus rounded down to the nearest 1,000 yen. This amount is then multiplied by the contribution rate and added to the monthly contribution. FYI: The maximum standard bonus amount for pension contributions is capped at 1.5 million yen per month.

Payment Process: Your employer deducts the contributions (both your share and their matching share) from your salary and bonuses, and ensures payment is made to the pension system by the following month’s end. For instance, contributions for April must be paid by May 31st.

While this is pretty much how the process works, there’s an exemption rule here. If you're on maternity or childcare leave, both you and your employer can apply for exemptions from contributions during this period.

This can help alleviate financial strain and is the only exemption rule that doesn’t affect your pension payments in the future.

To learn more about childcare benefits in Japan as an employee, we also recommend checking out our guide to childcare leave.

Do Foreigners Living in Japan Have to Pay Pension?: Japan Pension System for Foreigners

Yes, foreigners residing in Japan are required to participate in the pension system. This has to be either through the employee's pension insurance or the national pension system, depending on your employment status.

Can Foreigners Receive Pension After Leaving Japan?

If you're not yet sure whether you’ll live in Japan for the long term or return to your home country in your retirement years, you may be wondering what will happen to your payments.

So, will you be able to receive pension payments from Japan while abroad? Not really, but this doesn’t mean you’ll lose out on the contributions you’ve made in Japan.

Foreigners who leave Japan may be eligible for a lump sum withdrawal payment, as we explained in our other post about retiring in Japan.

This option is only available to those who contributed to the pension system for at least six months but plan to reside outside Japan permanently.

That being said, the payout is capped based on the duration of contributions. After 10 years, a lump sum payment is no longer an option, and until 5 years, you’re able to recoup all of your contributions. So, the length of your stay in Japan matters a lot here.

What’s more, this payment excludes any employer contributions and is subject to taxation, though you may be able to claim a tax refund later. This is a useful option for those not planning to retire in Japan as it provides a partial return on your investment in the system, but there’s one more thing you can do that arguably might be better for your future.

If There’s an International Pension Agreement Between Your Country and Japan

If your country has an international Pension agreement with Japan, transferring the contributions you made in Japan to your home country’s pension system is totally an option!

Unlike the lump-sum payment, there isn’t a set time limit here. Even if you decide to leave after ten years of contributing to the employee’s pension in Japan, you can still transfer your contribution to your country and retire from there.

This is why this option is arguably the better option. In the case of the lump sum payment, you won't be eligible for a pension with these contributions in your home country as you’ve already been reimbursed.

Who’s Eligible for an Exemption?: Pension Exemption in Japan for Foreigners

Certain individuals may qualify for exemptions from national pension contributions under specific conditions set by law.

For instance, those receiving the disability basic pension or public assistance under the Livelihood Protection Act are eligible for full exemptions.

In addition, individuals with limited income in the previous fiscal year (including their spouse or head of household) can apply for an exemption as well, which is subject to approval.

Exemptions come in various forms, such as full amount exemption, 3/4 exemption, half exemption, and 1/4 exemption, each affecting the required monthly contribution differently. To give you an idea, for Fiscal year 2024, the contribution amounts after exemption were as follows:

3/4 exemption: 4,250 yen

Half exemption: 8,490 yen

1/4 exemption: 12,740 yen

These exemptions impact the calculation of future pension benefits. For instance, periods of full exemption after April 2009 count as half of a full contribution period, while periods of partial exemption count proportionately based on the exemption level.

To apply, simply visit the municipal office where you reside. Keep in mind that applications must be renewed annually to maintain the exemption status.

Closing Words: Where To Consult If You Have A Japan Pension System Problem

Foreign residents who need guidance or assistance can consult Japan Pension Service offices located in major cities, including:

That said, these are hardly all of the offices. You can find a comprehensive list of offices and contact information for all cities and prefectures on the Japan Pension Service website. The website also provides resources in English for added convenience.

Get Job Alerts

Sign up for our newsletter to get hand-picked tech jobs in Japan – straight to your inbox.