Updated February 12, 2025

How to Read a Payslip in Japan

Trying to figure out Japanese pay slips can feel like solving a puzzle, especially if you're not familiar with them.

That said, since this is arguably one of the most important documents during your stay in Japan, you should learn how to read it and understand its components.

In this guide, we’ll break down the salary slip format in Japan and explain how to interpret it. We’ll also provide you with an example of a Japanese payslip in English so you know what it looks like even before receiving your first paycheck.

Let’s get right into it.

In this article: 📝

What’s Included in The Salary Slip Format in Japan?

Japanese pay slips pack a lot of information about your salary, additional payments, deductions, and work attendance, helping you keep track of your finances effectively.

At the top of your payslip, you'll typically find your personal details, such as:

Your name

Employee ID

Department

Right below that, you'll see:

The payment period

Your gross salary

Any deductions

Your net salary

While payslips can vary depending on the company and the benefits they offer, most are divided into a few key sections: attendance, payment, deductions, and net pay. Each section tells a story about how your salary is calculated and where some of your money goes before it eventually ends up in your bank account, so let's break them down in detail.

Attendance Section of a Japanese Pay Slip

The attendance part of your payslip keeps track of how many days you actually worked and any leave taken during the pay period. In a way, this is like your personal attendance record, and it directly affects your salary calculations.

This section typically includes:

Days Worked (出勤日数 – Shukkin Nissu): Shows the total number of days you were at work during the pay period.

Paid Leave Days (有給日数 – Yuukyuu Nissu): Records any paid leave taken during the period that covers the payslip.

Number of days absent (欠勤日数 – Kekkin Nissu): Shows the number of days absent from work. In principle, this is not subject to salary payment.

Late or Early Departures (遲刻/早退 – Chikoku/Soutai): Records any instances of tardiness or leaving work early.

Overtime Hours (残業時間 – Zangyō Jikan): Logs the number of extra hours worked.

As you can see, this section not only reflects your attendance but also ensures that your salary is accurate based on the time you've put in and any adjustments needed for advances or overtime.

Payment Section of a Japanese Salary Slip

The payment section of a payslip shows your earnings. It includes both your base salary and any additional payments that make up your gross income.

Here's what you'll usually find in this section:

Basic Salary (基本給 – Kihonkyū): This is the core of your paycheck, the amount agreed upon in your contract. It doesn't include any bonuses or extra allowances.

Overtime Allowance (残業手当 – Zangyō Teate): If you put in any extra hours, this line shows the compensation you earned for working overtime.

Bonuses (賞与 – Shōyo): Some companies pay seasonal or performance-based bonuses, which are recorded here.

Housing Allowance (住宅手当 – Jūtaku Teate): If your company supports housing expenses, they’ll show up here.

Commuting Allowance (通勤手当 – Tsūkin Teate): Many Japanese companies reimburse your travel expenses, whether it's for a train, bus, or another form of transportation.

Shift or Night Work Allowance (夜勤手当 – Yakin Teate): If you work irregular hours or overnight shifts, this extra allowance compensates for the inconvenience and is stated on your payslip under this item.

Absence deduction (欠勤控除 – Kekkin Koujo): This means your pay is reduced for the days or hours you didn't work. You might wonder why it's listed in the payment section if it's a "deduction." This is done for practical convenience and easier payroll processing, and it’s the standard format.

This section is undoubtedly the most exciting part of your payslip because it shows your earnings before deductions.

Deductions Section of a Payslip in Japan for Foreigners

The deductions are the amounts subtracted from your gross salary used to cover various mandatory contributions, such as healthcare, pensions, and taxes, that will benefit you in the long run.

Here’s a breakdown of what you’ll usually find in this section:

Health Insurance (健康保険 – Kenkō Hoken): This contribution provides medical coverage for you and your dependents. It's a key part of Japan's universal healthcare system and ensures access to affordable medical care.

Pension Contribution (原生年金保険 – Kōsei Nenkin Hoken): This is your contribution to Japan's national pension program, designed to provide financial support after you reach your retirement age.

Nursing Care Insurance (介護保険 – Kaigo Hoken): If you’re 40 or older, this deduction funds elder care services. It's an important part of supporting Japan's aging population.

Employment Insurance (雇用保険 – Koyō Hoken): This deduction helps provide financial support if you lose your job. It's a safety net that ensures stability during times of unemployment.

Withholding Income Tax (源泉所得税 – Gensen Shotokuzei): This deduction is calculated based on your taxable income and the applicable tax rate. This is one of the deductions that don't really benefit you and is merely your income being taxed.

Residence Tax (住民税 – Juminzei): Also called the municipal tax, this local tax is paid to your municipality and varies depending on where you live.

Social Insurance (社会保険 – Shakai Hoken): This deduction covers the total amount for employment insurance, health insurance, nursing care insurance, and Pension Contribution. Read more about these in our article on social insurance in Japan.

Some pay slips may also include deductions for company-specific benefits, union fees, or other voluntary contributions. So, double-check this section to ensure that everything aligns with what you agreed upon in your contract.

You might be quick to trust a business due to the legitimacy they give off and for the fact that they hired you, but transparency and knowing what’s exactly deducted from your salary helps you understand exactly where your money is going and ensures you're never undercharged.

Is The Pay Slip in Japan Online or in Paper Form?

Many companies in Japan nowadays use electronic pay slips, which are accessible through secure portals provided by the employer.

These digital versions are becoming increasingly popular because they're easy to access, store, and share when needed. Plus, they're better for the environment—all the more reason to make them more commonplace.

That being said, some companies still use the traditional paper format for pay slips, which take up physical space and might be harder to keep organized (more on this later).

So, if you receive electronic pay slips, be sure to download and store them in a safe place, like a cloud drive or personal folder.

On the other hand, if your company provides paper slips, consider scanning them to create a digital backup of all the pay slips you receive. Either way, keeping these records organized ensures you'll have them when needed.

Storing Pay Slips: Why You Should Keep Your Japanese Pay Slip

Keeping your pay slips is very important, at least for a certain while.

They're much more than just a record of what you've earned—they’re your financial proof for a variety of situations, such as:

Filing taxes or claiming deductions: Your pay slips can help you verify your income and calculate deductions during tax season.

Proof of salary for loans or visa applications: Whether you're applying for a mortgage, a personal loan, or a visa, pay slips are often required to prove your income stability.

Resolving pay disputes: If there is ever a discrepancy with your salary or deductions, pay slips provide essential documentation to resolve the situation.

Tracking financial contributions: Pay slips also show exactly how much you contributed to pension, taxes, and insurance over time.

To keep things simple and stress-free, keep your payslips organized and secure.

What To Do If There’s A Mistake: Resolving Errors in Pay Slip in Japan for Foreigners

Mistakes can always happen, and while they can be frustrating, they're usually fixable if you act quickly. If something doesn't look right on your payslip, here are a few tips for how to handle it:

Double-check the details: If you think a mistake may have been made, start by comparing the numbers on your payslip and previous pay slips. Look for discrepancies in your basic salary, overtime, payments, or deductions.

Contact HR or payroll: Reach out to your company's HR or payroll department as soon as you notice an issue on your pay slip. Be specific about the error, whether it's a missing allowance, incorrect deduction, or any other discrepancy.

Provide documentation: Gather any supporting documents such as attendance records, previous pay slips, or your employment contract to back up your claim.

Follow-up: Mistakes can take time to resolve, so don't hesitate to follow up if you don't hear back. Keep a record of all communications, including emails and notes from any meetings, to cover all of your bases.

Request a corrected payslip: Once the issue is resolved, don’t forget to ask for a revised payslip to ensure that the record you keep of your pay slips stays accurate.

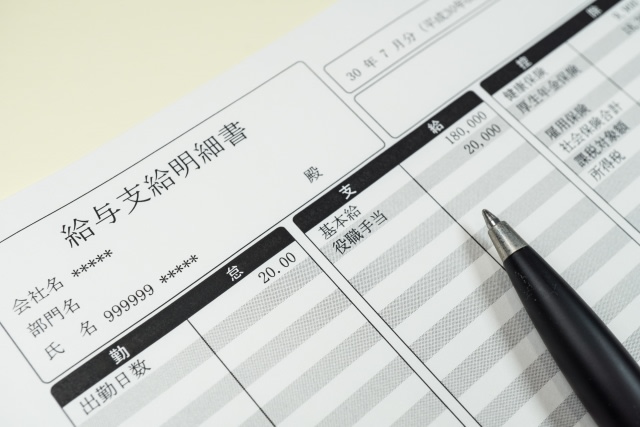

Example Salary Slip Format in Japan: Japanese Payslip Translation

Now that you know all the essentials about pay slips in Japan, let’s see what a Japanese pay slip looks like. You can also find an English translation of what it all means right below.

Please note that the figures in the pay slip below are examples only and will vary depending on your individual circumstances.

| 給与明細書 | |||||

|---|---|---|---|---|---|

| 支給 | 控除 | その他 | |||

| 基本給 | 260,000 | 健康保険料 | 11,800 | その他支給 | 0 |

| 時間外手当 | 0 | 厚生年金保険料 | 21,960 | その他控除 | 0 |

| 課税支給合計 | 260,000 | 介護保険料 | 0 | 合計 | 0 |

| 雇用保険料 | 920 | ||||

| 非課税通勤費 | 5,000 | 社会保険料計 | 34,265 | ||

| 所得税 | 3,770 | ||||

| 非課税支給合計 | 5,000 | 住民税 | 2,000 | ||

| 支給合計 | 255,000 | 控除合計 | 34,595 | 差引支給額 | 220,405 |

To understand it better, here it is in English as well:

| Payroll Slip | |||||

|---|---|---|---|---|---|

| Payments | Deductions | Other Items | |||

| Basic Salary | 260,000 | Health Insurance | 11,800 | Other Payment | 0 |

| Overtime Charge | 0 | Pension Insurance | 21,960 | Other Deduction | 0 |

| Total of taxable payment | 260,000 | Care Insurance | 0 | Total Other Items | 0 |

| Labor Insurance | 920 | ||||

| Non-taxable commutation | 5,000 | Total Social Insurance Premium | 34,265 | ||

| Withholding Income Tax | 3,770 | ||||

| Total non-taxable payment | 5,000 | Inhabitant Tax | 2,000 | ||

| Total Payment | 255,000 | Total Deductions | 34,595 | Net Payment | 220,405 |

While this is all we have on payslips in Japan, all this money talk might leave you wondering more about the state of salaries in Japan.

Lucky for you, we have other detailed guides you can check out to stay informed on topics like software developer salaries, the highest-paying programming languages in Japan, and Japanese payroll practices.

Get Job Alerts

Sign up for our newsletter to get hand-picked tech jobs in Japan – straight to your inbox.